The world of personal finance feels different today. Once upon a time, asking for a loan meant long queues, endless forms, and waiting weeks before hearing back. Now, with everything moving to our phones, getting money is less about paperwork and more about a few taps. For someone just starting their financial journey, it can feel both exciting and confusing. Where do you even begin?

Let’s say you’re stuck in one of those situations where you need instant money—not next week, not after the bank’s approval cycle, but right now. Maybe an emergency expense came up, or maybe you just don’t want to dip into savings. That’s where online loans come in. Quick, convenient, and honestly? Less scary than most people think.

The first step is understanding online finance. Think of it as the digital cousin of your traditional bank. Instead of going branch-to-branch, you scroll through apps or websites. Everything from filling out details to submitting documents can be done online. It means no waiting for office hours, no wasting half a day just to submit a form. For busy students, working parents, or really anyone who doesn’t like running errands, it’s a blessing.

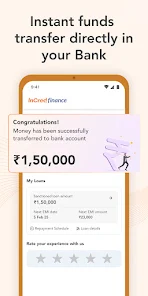

Now, where do you actually go for these loans? The money lending app. These apps have become really popular because they make the whole process smoother. Download the app, sign up, and most of the time you’ll just need to upload basic KYC documents—ID proof, address proof, maybe income proof depending on the amount. Some apps even let you link your bank account directly, making the transfer almost seamless.

Of course, the reason so many people are curious about online loans is speed. A quick loan doesn’t mean careless approval. It’s more about technology making things faster—AI-driven checks, automated verification, instant eligibility scans. In many cases, once your documents are approved, money lands in your account within 24 hours. Sometimes even within minutes. Compare that to the old system—it’s no wonder this method has grown so much.

But here’s where we pause for a second. Just because it’s fast doesn’t mean you should click “apply” without thinking. Treat it like any other financial decision. Look at interest rates, repayment timelines, and late fee penalties. Some platforms are transparent, others not so much. Reading the fine print may feel boring, but trust me, it saves headaches later.

Another tip? Don’t apply to five different apps at once. Each application may leave a footprint on your credit report. And multiple hard checks in a short time can lower your score. Instead, shortlist one or two credible platforms, compare, and then apply where you feel most comfortable.

So, how do you apply, step by step?

- Choose your platform (a trusted bank site or a popular app).

- Register with basic details.

- Upload documents digitally.

- Review loan terms carefully.

- Hit apply and wait for the approval notification.

Simple enough, right?

Online loans aren’t just about convenience—they’re about access. People in smaller towns, those who might not always feel confident walking into a bank, can now borrow with ease. That’s a powerful shift. Technology is making finance inclusive, not just efficient.

At the end of the day, applying for a loan online is like any tool. Use it wisely; it works for you. Use it recklessly, and it might cause stress. But for most of us—students, young professionals, families balancing expenses, it’s one of the most practical ways modern finance has evolved.

No Responses